Despite being on the right politically I have always been an optimist, we will prevail, the economy will right itself (no matter how badly George Osborne does) and we will return to rising living standards and wealth, health and happiness all around. But cracks are appearing in the mirror, doubts are creeping in and the “Black Dog” of Secular stagnation is starting to howl.

|

| The Black Dog of Secular Stagnation |

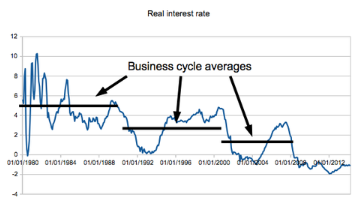

Yesterday Paul Krugman (PK) posted a short piece, without a fanfare or any of the normal self-importance with three charts, which he said illustrated the dangers of secular stagnation. Secular stagnation is an old idea given fresh legs by PK and his mate Larry Summers (Ex-Secretary of the US Treasury under Clinton). Both have, eloquently if not convincingly, set out the premise that its possible for an economy (even at zero or negative real interest rates) to be unable to escape the liquidity trap – where aggregate demand suppressed by low growth, falling productivity and low investment will be unable to create the economic momentum to reach “escape velocity”. I had not seen any convincing of evidence for this awful scenario – that is until yesterday when I spotted this chart in PK’s post.

The chart plots real interest rates (Actual rates less inflation) in the long run across three and a half business cycles, between 1980 and today and it shows that in each subsequent cycle monetary policy has had to dig deeper to create growth. You will notice that this is simply expressed as a flat line across the business cycles – so in the cycle 1980 -1990 the average real interest rate was 4.5% and in last cycle it was just over 1.5% and in the current cycle the line will eventually be drawn at around -0.75%. This means that to sustain “normal” levels of growth we now need negative real interest rates, and no one knows how to deliver this – the last 20 years of Japanese economic history confirms this.

Let us suppose some brilliant mind (Mark Carney might do it) comes up with a set of proposal that create conditions where prolonged negative real interest rates can support decent rates of sustainable growth, that might be helpful and even necessary but it would turn the world up-side down. Here is a short list of unavoidable repercussions:

• There would be no middle class – no need or point in saving

• An aging population will have to keep working indefinitely

• There would be little no private investment in capital intensive businesses

• Governments would have to take sole responsibility for long term investment projects and public debt as a percent of GDP will have to rise even further

• The really rich will get proportionately richer as liquidity and leverage rule

• There would be a surge in self-employment, tax avoidance and rising public debts

• In short things could be pretty miserable!

There are now distinct signs that in Europe and the US that this economic rigor mortis has set in, whereas in the UK we look immune for now, but as secular stagnation strengthens its grip on the old world economies the contagion will spread to our shores eventually.

I have just read this blog post a redirect from the FT the final list of repercussions sums up the present situation !

ReplyDelete